Since I achieved my goal of paying my Target Visa card off last month, this month I threw a huge chunk of change towards my Capital One card!

$632 to be exact.

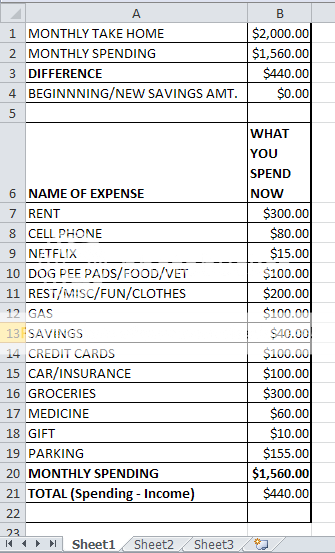

It was pretty much all the extra income I made from surveys and my blog and I am going to use the snowball method from this budget post to pay it off within the next two months.

I can't wait!