A lot of financial experts tell you to get rid of your credit card

debt and then never accrue any again. They reassure you that it's okay

if you basically don't have a credit score because you can use cash and

that's all fine and great and I love that they say that.

But the problem is... it's not for everyone.

But the problem is... it's not for everyone.

There

are just some times when we don't have the cash saved up for a large

purchase. And maybe you know that you don't have the ability or extra

time in your life to take on 2-3 more jobs. And that's totally fine!

Stop stressin'.

This post is going to be more for those of you that can control your bad habits with credit cards. If you are struggling and still use them even though you're paying down debt, stop reading. Instead check out my post on how to pay off debt. But for the rest of you, I'm going to tell you how you can use your credit cards properly in order to boost and maintain your credit score.

So if you're ready to still practice good behavior with your finances AND use a credit card - read on!

Opt for Credit Cards with Rewards

If you're going to go through the hassle of using a credit card and paying it off, you should probably get something back for it, right? So do some research on credit cards that offer rewards on every purchase. Don't just go for one with travel rewards if you NEVER travel. I have a credit card through my credit union that gives me 2% back on every single purchase and another credit card that gives me 5% on specific expenses on a quarterly basis. If it's gas giving me 5% back for a few months, I'll use that card for my gas purchases. Simple as that.

If you're part of a credit union always check them out first. Otherwise, Nerd Wallet has a great article on the different credit card reward programs they love.

Also, don't use a billion cards. Use 1 or 2. That's it. That's all you need to be actively using.

Use It As A Debit Card

If you can't grasp this concept you should just stop reading this article but if you are able to responsibly use a credit card, use it like a debit card. Only use it for expenses you already have that cash money available for. Do NOT use it as a credit card for things you want that you don't have the money for. Simple as that.

If you follow my system of budgeting and cash envelope spending system then you already know what categories you budget for and that's a great way to use a credit card. If you budget $100 a month for your parking garage, you can put that $100 charge on the credit card and pay it off between your paychecks that month rather than move the money into your Parking Share in your bank account, or taking the parking money out in cash. If you use cash for gas, instead of taking the gas money out of the ATM on payday, you can pay off your gas charge on your credit card bill.

Understand the 2 Important Dates

There are 2 super important dates on your credit card statement each month. In fact they are really the only 2 that matter.

The payment date is the most important one because it's the date you have to make your payment in full from the purchases on that cycle without being charge a late fee or interest. This date is the same each month so once you know it, you won't need to search for it every month.

Your account statement closing date is the next important date. It can vary each month depending on how many days are in your billing cycle from that month. But the account statement date is the date that your card statement will be generated. All the transactions that happened from your last statement's closing date and this one are going to be on your bill. Also, after that closing date, your lender reports everything to the credit bureau.

So why do you need to know these two dates and what does it have to do with boosting your credit score? Well, when the lender reports everything to the credit bureau it's showing that you're actively using your card with an outstanding balance. If you paid it off in the same billing cycle, when your statement comes, you may have a zero balance. To the credit bureau, that means you're not using it up to their standards. They don't care that you charged $500 total but already paid it off in full. They WANT you to have an outstanding balance. All you have to do is pay that balance in full by the due date. And you'll be back to zero with those purchases but when your next cycle ends, and it gets reported to the credit bureau they'll see that you indeed paid off the outstanding amounts from the last bill.

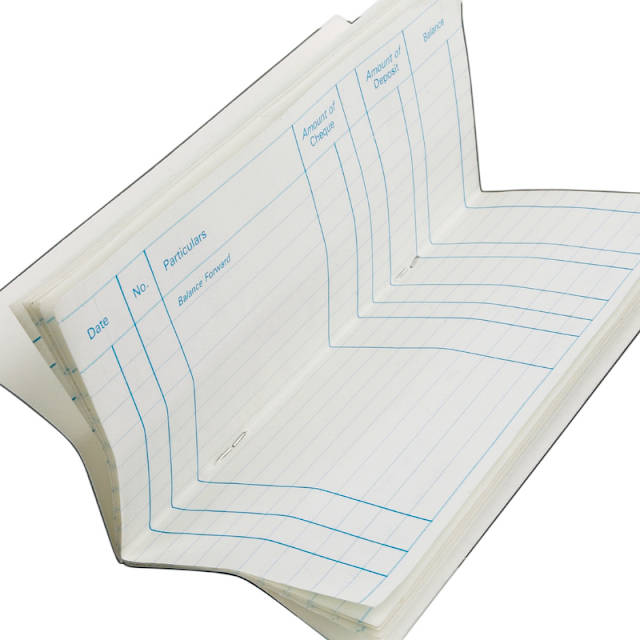

Log Your Transactions

Now this goes hand in hand with the last point. Don't pay attention to what your account balance says. Focus on what your tracking log says. Write down or somehow track all of the purchases you make on your credit card. Mark down when you make payments and figure out your current balance that way. This way will ensure you are on top of everything. You won't have to sit there and try to match things up and do a lot of math. Obviously, when you get your statement each month, make sure there's no purchases that you DIDN'T make, because that could be a sign of credit card fraud. Logging your transactions with the date will also remind you what items were charged AFTER the cycle closing date listed on your current bill. Those won't need to be paid by your next due date. Instead they'll be on the following month's due date and bill.

Pay Your Outstanding Balance IN FULL

When you see the outstanding balance on your credit card statement, make sure it is PAID IN FULL by the due date, also listed on the statement. You MUST do this in order to keep your finances in order AND maintain a healthy credit score.

Now, are you ready to start using your credit card to your advantage?

This post is going to be more for those of you that can control your bad habits with credit cards. If you are struggling and still use them even though you're paying down debt, stop reading. Instead check out my post on how to pay off debt. But for the rest of you, I'm going to tell you how you can use your credit cards properly in order to boost and maintain your credit score.

So if you're ready to still practice good behavior with your finances AND use a credit card - read on!

Opt for Credit Cards with Rewards

If you're going to go through the hassle of using a credit card and paying it off, you should probably get something back for it, right? So do some research on credit cards that offer rewards on every purchase. Don't just go for one with travel rewards if you NEVER travel. I have a credit card through my credit union that gives me 2% back on every single purchase and another credit card that gives me 5% on specific expenses on a quarterly basis. If it's gas giving me 5% back for a few months, I'll use that card for my gas purchases. Simple as that.

If you're part of a credit union always check them out first. Otherwise, Nerd Wallet has a great article on the different credit card reward programs they love.

Also, don't use a billion cards. Use 1 or 2. That's it. That's all you need to be actively using.

Use It As A Debit Card

If you can't grasp this concept you should just stop reading this article but if you are able to responsibly use a credit card, use it like a debit card. Only use it for expenses you already have that cash money available for. Do NOT use it as a credit card for things you want that you don't have the money for. Simple as that.

If you follow my system of budgeting and cash envelope spending system then you already know what categories you budget for and that's a great way to use a credit card. If you budget $100 a month for your parking garage, you can put that $100 charge on the credit card and pay it off between your paychecks that month rather than move the money into your Parking Share in your bank account, or taking the parking money out in cash. If you use cash for gas, instead of taking the gas money out of the ATM on payday, you can pay off your gas charge on your credit card bill.

Understand the 2 Important Dates

There are 2 super important dates on your credit card statement each month. In fact they are really the only 2 that matter.

The payment date is the most important one because it's the date you have to make your payment in full from the purchases on that cycle without being charge a late fee or interest. This date is the same each month so once you know it, you won't need to search for it every month.

Your account statement closing date is the next important date. It can vary each month depending on how many days are in your billing cycle from that month. But the account statement date is the date that your card statement will be generated. All the transactions that happened from your last statement's closing date and this one are going to be on your bill. Also, after that closing date, your lender reports everything to the credit bureau.

So why do you need to know these two dates and what does it have to do with boosting your credit score? Well, when the lender reports everything to the credit bureau it's showing that you're actively using your card with an outstanding balance. If you paid it off in the same billing cycle, when your statement comes, you may have a zero balance. To the credit bureau, that means you're not using it up to their standards. They don't care that you charged $500 total but already paid it off in full. They WANT you to have an outstanding balance. All you have to do is pay that balance in full by the due date. And you'll be back to zero with those purchases but when your next cycle ends, and it gets reported to the credit bureau they'll see that you indeed paid off the outstanding amounts from the last bill.

Log Your Transactions

Now this goes hand in hand with the last point. Don't pay attention to what your account balance says. Focus on what your tracking log says. Write down or somehow track all of the purchases you make on your credit card. Mark down when you make payments and figure out your current balance that way. This way will ensure you are on top of everything. You won't have to sit there and try to match things up and do a lot of math. Obviously, when you get your statement each month, make sure there's no purchases that you DIDN'T make, because that could be a sign of credit card fraud. Logging your transactions with the date will also remind you what items were charged AFTER the cycle closing date listed on your current bill. Those won't need to be paid by your next due date. Instead they'll be on the following month's due date and bill.

Pay Your Outstanding Balance IN FULL

When you see the outstanding balance on your credit card statement, make sure it is PAID IN FULL by the due date, also listed on the statement. You MUST do this in order to keep your finances in order AND maintain a healthy credit score.

Now, are you ready to start using your credit card to your advantage?

PIN THIS POST

No comments:

Post a Comment

I love reading and responding to comments but in order to get my reply you must ensure you are NOT a no-reply blogger. If you are, here are some quick steps to change that!

1. Go to the home page of your Blogger account.

2. Select the drop down beside your name on the top right corner and choose Blogger Profile.

3. Select Edit Profile at the top right.

4. Select the Show My Email Address box.

5. Hit Save Profile.