Why does it feel so overwhelming to even THINK of trying to pay down your outstanding debt?

It just seems like you'll never get ahead and never get rid of it all which can make trying to come up with a plan of attack really frustrating and even discouraging.

Well, today I'm going to walk you through how to create a debt pay down plan and how you can actually stick to it so that you become debt free!

Step 1 | Know What You're Working With

The absolute first thing you MUST do to begin paying down your debt with intense focus is know EXACTLY what you owe and to whom. That means every medical bill, every credit card statement, every car loan, and every personal loan (money borrowed from a friend) needs to be gathered up and written down on a list. You can use this free template to print and start your own list. There's also a column to write down the minimum payment amount which you'll need in a bit.

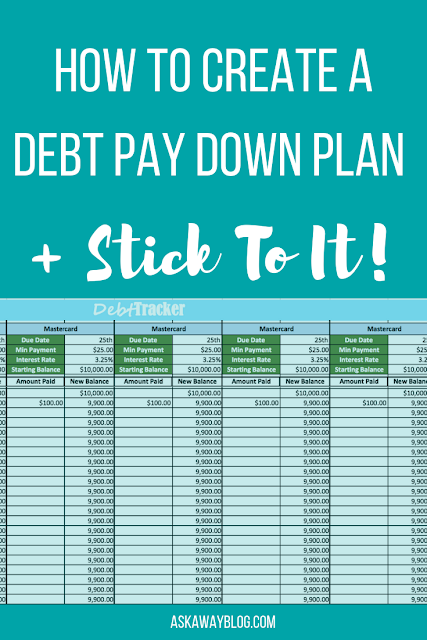

Step 2 | Create a Debt Pay Down Tracker

You will now enter your debts into some sort of a tracker and to do that I highly recommend using a spreadsheet. Good news! I have a Debt Pay Down Spreadsheet you can get for free here! This allows you to know what you currently owe on your debts each month and also tracks your payments. It's also a motivational tool because you'll watch your debts go down and be determined to pour as much as you can into the next debt.

If you don't already have a budget, you should make one using the free Budget Template and my blog post on creating a budget. You'll want to look at the amount you have in the difference cell - the one that tells you what's leftover from your Income - (minus) your Expenses. That amount SHOULD reflect what you have left after your utilities, savings, and spending money comes out each month. That's the amount you want to use to attack your debt.

If you don't have a very high number, you may need to tweak some of the categorizes in your budget to allow more money leftover for your debt. This is where you'll want to get creative and think of all the places you can cut back. Maybe you can reduce your utility bills by adjusting your thermostat, or reducing your cable plan. You can shop smarter at the grocery store and use meal planning. This is where you really need to put in the effort if you want to go hardcore at becoming debt free. Give up those Starbucks drinks every morning and brew your own coffee at home.

Step 4 | Choose a Debt to Focus On First

The way the debt pay down process works is that you pay the minimum on every debt except your smallest one. Your smallest one will get the minimum payment plus anything extra leftover in your budget. The smallest debt will also be the easiest and quickest to pay off.

When you focus intensely on one goal and one debt it can really make the process a lot more enjoyable. You'll feel like you're making progress on that one goal/debt rather than feeling pulled in every which direction for your other debts.

Step 5 | Use All Extra Income To Eliminate that Debt

Again, you want to use ALL AVAILABLE LEFTOVER INCOME EACH MONTH on your debt. If you receive money for a holiday, use that towards your debt. If you get a tax refund back, use that for your debt. If you work overtime at your job, use that for your debt.

Step 6 | Use the Snowball to Gain Momentum

Once you pay your first debt off, you can celebrate and feel REALLY GOOD!!! But now it's time to build your debt pay down snowball. You will now pay the minimum on all your debts still, but the next lowest debt in line is going to get the minimum PLUS the minimum from your paid off debt PLUS whatever else extra you can put in each month. So if you paid $25 minimum on your recently paid off debt, $25 minimum on this next debt, and whatever extra you had each month, you'll now be paying $50 minimum on this next debt PLUS whatever else you can get together each month. By the time you move on to your last debt, you'll have a large chunk to throw at it each month and it'll knock it down quicker than your first debt!

Hopefully you feel a big more comfortable with how the debt pay down process can work and you're getting motivated to knock out your first debt!

Remember I offer a financial e-course that offers ALL THIS and much more. Register here today!

PIN THIS POST

My husband and me do something similar to this.

ReplyDeletehttp://www.amysfashionblog.com/blog-home