It's a new year and time for a fresh start. Maybe you plan to start eating better, being more positive, keeping your home more tidy, or even just taking more time for YOU. But when it comes to your finances and starting fresh, you're probably feeling pretty overwhelmed.

Am I right?

Do you feel like you are broke or living paycheck to paycheck and you have no idea how to break the cycle? You want to get rid of your obnoxious debt don't you? But you also know you need to save money but how in the heck are you expected to do both at the same time!?

Well - RELAX! I'm here to tell you that you CAN do it and I'm going to help you !

See I was once like you and if I can overcome it, then you certainly can!

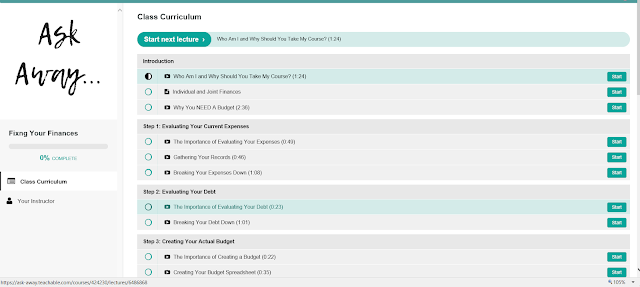

That's why I've officially launched an e-course called Fixing Your Finances!!!

You can enroll here for just $25 which is almost a 50% discount from the regular price!

So what will you get out of this course? Well, A LOT!!! But let me try to break it down for you!

Evaluating Your Current Situation

First, we will start off by looking at your current spending habits and outstanding debts. You'll have to hold yourself accountable and face your issues head on by gathering receipts, card statements, and bills and breaking every expense into a category. It seems scary but it's seriously a crucial step to realizing what you need to change.

Creating A Realistic Budget

Budgets are great because they are the command center for everything relating to your money. And the best part is you can control your budget and then let it do the work for you. Budgets don't mean you can't spend money, it just means you need to be more careful about how much you spend on certain things at certain times. We'll use the amounts you've spent over the last 6 months to a year to determine what you should set aside each month in your budget for that type of expense. I'll give you lots of ways to tweak your amounts so that your income IS GREATER THAN your expenses. Yes, you read that right!

Boosting Your Income

I will go over lots of options for ways to increase your income whether it's a side hustle or something as simple as selling your unused stuff.

Emergency Savings

An emergency savings is a very important step to ensure you don't have to go into debt to pay for an emergency so we'll go over how much you should save and how you can accumulate that money ASAP!

Regular Savings

Everyone wants to have a healthy savings fund in the event that something HUGE occurs like losing a job, a natural disaster, etc. So I'll motivate you to get your savings built up when you're at that step in fixing your finances and I'll talk about what to do during some of those life-changing events.

Becoming Debt Free

Everyone wants to be debt free, right? I love waking up not owing ANYONE money except my mortgage company. It feels so great and so liberating. I want you to feel the same way. Remember, I went from over $25,000 in credit card debt to ZERO in just a couple years. I'll give you the tools you need to become debt free by tracking your debt pay down, showing you ways to get the money you need to become debt free, and how to deal with creditors!

Tips for All Things Finance

Whether it's using credit cards wisely to boost your score, investing in your retirement, or even your children's financial future, I'll give you tips and advice on how to make the best financial decisions in the future.

Each lesson has videos, free worksheets, and full text to guide you through each step of getting your finances on track.

Click here to REGISTER TODAY before the special pricing ends!

PIN THIS POST

Happy New Year.

ReplyDeletehttp://www.amysfashionblog.com/blog-home