I hear it all the time when someone says they live paycheck to paycheck and I tell them there's way to stop. "I am great with money, I just don't make enough." I get it, I really do, because I think I make decent money too but somehow if I'm not careful I end up struggling to get by till 2 Fridays from the day the money even lands in my bank account. Remember, I became debt free several years ago so if anything, I have zero excuses.

The thing is, you aren't alone. Many of us struggle to get by between paychecks. A lot of the time we don't realize how much we're spending. Other times, we just don't make enough but there's still a way to pin point EXACTLY how much you can afford each month and still get by.

So here are 5 easy steps to start the process of financial freedom and stop living paycheck to paycheck.

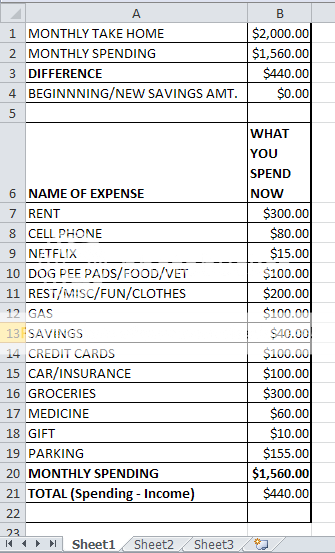

1. Write down all of your monthly bills/expenses. These would include rent, mortgage, car payments, credit card bills, utilities, memberships, etc. Subtract the total of those monthly expenses from your monthly take home pay. This is how you find out whether you break even, have a positive number, or a negative number. Negative means you need to re-balance your budget and YES you can be on a budget while living paycheck to paycheck!

2. Check your spending from the past month. Pull up all your bank statements and any receipts you have for a whole month and see where all the rest of your money goes. This is the point where you will see the unnecessary expenses. You don't always NEED to get coffee on the go (make your own at home and bring it with you) or add candy bars to your shopping basket at the pharmacy. Once you take a long hard look at your behavior it's easier to KNOW you need to change.

3. Analyze your spending. You'll need to figure out which of those expenses can be deemed necessary or which are able to be reduced. Starbucks every morning can be reduced. There are even ways to cut back on grocery expenses if you shop smart. So you will want to brain storm pretty seriously on everything from your cable package to your gasoline consumption when driving.

Next, you want to take all of the expenses that you are going to allow (remember rewarding yourself is necessary) on a monthly basis and categorize them. For example:

Entertainment - This category can be for concert tickets, bars, movies, and other events.

Restaurant/Dining Out - This category can be for lunches you buy during the week, fast food, date night dinners.

Miscellaneous - This category is good for stuff that you can't fit in any other category. I used to have this category in my own expense system and then I made sure to categorize every possible expense. Emergency runs to get a new lampshade when one falls and gets beaten up is covered by Home Decor category.

Groceries - This category is obviously for food and toiletries.

4. Split it. Look at the number you got from subtracting your monthly expenses from your income. And then look at how you can divvy that number into all the categories you made in step 3. You want to decide on a monthly amount for each category, perhaps based on how you've been spending, or how you want to spend, or even what you know you need each month (hello, everyone needs a date night). Then you will split that amount by category by however many paychecks you get in a month which for most people paid bi-weekly is 2.

The reason you do this is to determine how much cash you should take out each paycheck on payday and assign to envelopes.

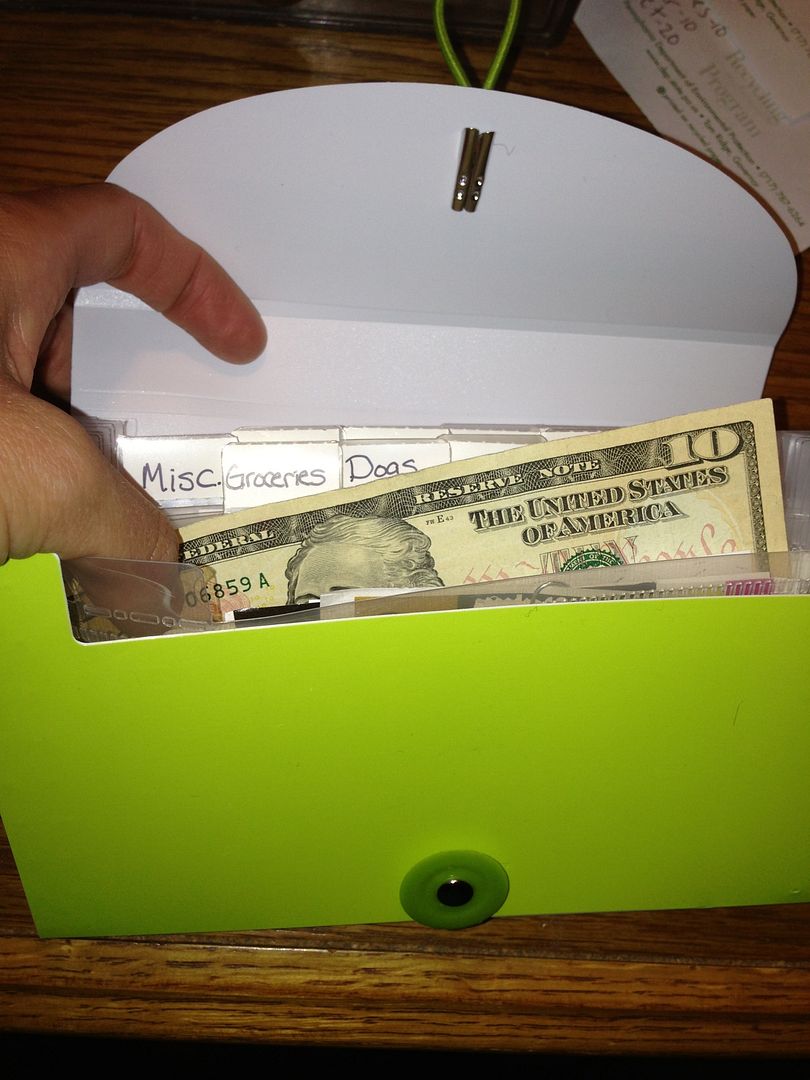

5. Create a cash envelope/ budgeted spending system. You can refer to my post on a cash envelope system in order to discipline your spending to only a certain amount for each category This way, you aren't depriving yourself, you're just living frugally. And this post has ways to actually make a fun envelope system! Remember, you need to keep your income minus expenses at zero or above. That means make some major steps to make extra money each month or to cut back on expenses.

If you don't know where to start even after reading this post, you can get free templates for debt pay down and budgeting here! I've done most of the work for you and you just need to plug in your own numbers.

Also be sure to check out my book, Fixing Your Finances, available for just $11.99 on Amazon! I will go over how to turn your finances around no matter what your situation. If I can do it, so can you!

I absolutely love this!! Definitely going to try this all!

ReplyDeletexo

www.jennaleeann.com

Thanks Jenna let me know how it goes!!!

Deletevery organized, efficient.

DeleteI would cut the phone bill down to a prepaid phone $25-35.00 a month. Maybe take out parking and use public transportation.

DeleteI would cut the phone bill down to $25-35.00 a month with a prepaid phone. Also try pubic transportation since you have to pay for parking. Pay extra on the credit cards to cut down on the interest the credit cards charge you.

DeleteA really good idea!

DeleteWhere did you get the booklet/envelopes for your cash system?

DeleteSimple, practical, do-able! This is great advice. Thanks for sharing it!

ReplyDeleteP.S. Thanks for your super sweet comment today!

Alison

The envelope system really is smart! We don't use it- but we have recently been saving for a house, and have very much cracked down on where we are spending money and monitoring it closely in order to be better about saving!

ReplyDeleteGood for you!!!! hope everything goes well with saving for the house :)

DeleteDefinitely checking out your envelope system. I'm terrible with money, it's my goal this year to improve. I know where it's going (the restaurants/bars and transportation categories) but I can't seem to stop myself!

ReplyDeletei know... thats why the cash helps because it nearly makes it impossible for you to spend it when the envelope is finally empty!!!

DeleteThat's so true! An empty envelope is much better than an overcharge fee at the bank!!! I used this system years ago, and what I found was if I budgeted 300 for groceries and only spent 280, guess what, that 20 became spending money if I was absolutely feeling deprived!!! Or, it went into savings like a good girl :)

DeleteYep! An empty envelope reminds you to question DO i really need what i want to buy? Nope!

DeleteGreat advice! I would say that I am good with managing my money, but there is always room for improvement!

ReplyDeletePS - can I live where you do? $300 for rent sounds like a dream.

haha i moved back home with my parents temporarily...its not the greatest but it def helps me save and pay off my debt in the meantime!

DeleteThat's how I saved for my first house. It was tough moving home at 28, but I pretended to have a mortgage for 2 years. I put "rent" away in a money market account on the1st of every month and assumed the $500 I paid the 'rents would cover utilities and other home costs.

DeleteI live in a nice one bedroom apt in east Tennessee. Water is included for $275 month

DeleteGreat tips. I really enjoyed it!

ReplyDeleteChristina

http://www.christinasstyle.com/

Thanks for reading Christina!

DeleteThese are great tips! I have a coworker who is constantly complaining about money but doesn't do anything about it. I just want to tell him to make a plan and stop spending so much!! Writing down your spending really helps so much!

ReplyDeletewww.amemoryofus.blogspot.com

I know right! Thats why I'm like EVERYONE READ THIS SO YOU CAN STOP COMPLAINING! haha! Thanks for reading Darcy!

DeleteThere are truly those people who don't make enough to cover the essentials - food, rent, utilities. But most of us complain and don't realize that 3 or 4 Starbucks coffees a day adds up to rent money for the month. Thanks for making it simple and not "preachy".

ReplyDeleteso true jill!! Glad you liked this post. i always look for feedback from people!! i really appreciate it!

DeleteCant wait to try this!

ReplyDeletewhat if your paycheck isn't enough to cover your everyday things, car, morgage, condo fees, gas food + debt that your in :( HOW DO I GET OUT OF CREDIT card debt soo screwed :(

ReplyDeleteThe way I did it, I chose the credit card with least amout owed and applied an extra $100 per month to pay it off. While doing this I only paid minimum amounts on the other credit cards. Once I paid off the first credit card I used that full amount plus what I would normally pay on the next card and paid it down until all cards were paid in full.. You will be surprised at how fast this will work. You can also choose to pay off the highest interest bearing card first. Just start somewhere and cut back on the stuff you really dont need. :)

DeleteThis is a great system but make sure you pay off the card with.the highest interest rate first otherwise you end up spending more in the long run. This strategy is perfect though!

DeleteOops. Just read the end of tour post. :)

DeleteI use that method to pay off all my student loans. It is a slow process at first but after a few month you start to really see the difference!

DeleteI work in title loans an we have high interest rates I always advise customers to break up min so it easier for them to pay over due to minimum is only intrest

DeleteFYI - highest interest isn't always the best strategy, there are other factors involved such as balance, payment amount, you really have to run the numbers and scenarios to truly know. Most recommend paying lowest balance account first to have the snowball effect quicker.

DeleteWhere did you get the cash wallet shown in this picture?

ReplyDeletehow about when you pay 800 for rent? and150 for insurance? there is nothing left to save even if you want...

ReplyDeleteThen it's time to look to make extra income! What if you worked towards yourself instead of your bosses pay check

DeleteIt would be lovely to just work for yourself while working 9-5, but that's not always a simple solution. No matter what business you go into, you don't make money right at the jump. Of course work hard and the reward will come, but it's not a quick fast solution. It's definitely an idea to look into so I'm not saying to rule it out.

DeleteStart looking for a roommate or maybe you aren't living in a place that you can truly afford on what you are taking home.

DeleteMaybe look for an extra part-time job, or send what you have around home, that you don't need, love, use. See about selling those things, taking all that money, however much or little it may be, and put it all towards the 1 debt you are starting your payoff with. Then in a couple weeks or months, look around again for more you don't use, need, love. Repeat.

DeleteJobs. Consider pizza delivery, newspaper delivery, etc. Or as a stocker in bigger stores. Or bagger or such in grocery store. Never easy, but doable, even if you have some disability.

I'm due with my first child in May! I'm really hoping this works, I want to be able to save money for my 6 weeks of maternity leave.

ReplyDeleteIt's a filofax.

ReplyDeleteWhat kind of filofax?

DeleteMy question is how do you begin to put funds for future bills (even the next week's bills) in an envelope when you have no money left from your current week's/month's bills to spare? I sometimes have maybe $10 or $20 dollars left after groceries, gas, bills, etc. How can I start the envelope system when all my money is already virtually gone? I guess I just need to know how to get started putting money back for expenses when there's none there.

ReplyDeleteI know, its very tough at first. What i did after a few paychecks (you gotta get on a schedule) isfigure out which paycheck which bills would come from. Or if i have to take some from one paycheck and some from another. You may not have as many categories as me and thats okay but like for groceries, i looked at what i spent every month on my debit card, and i took around that much cash out then... i split it up... if i spent 400 a month on groceries (i didnt but just using as an example), I would take 200 out of every paycheck (2 checks). .

DeleteI have had to scrimp through some pretty lean times with a family of six (especially when I was out of work and my husband was/is a teacher), and I can really stretch a dollar, especially grocery dollars. Really be careful at the grocery. Cut out junky snacks; make healthier, less expensive stuff at home. And I am lucky to have an Aldi's nearby, where most of my food $ went. We lived on chicken and pork for our meat from the big box grocery, and I stocked up on "Manager's Specials" since I have a freezer. I made one meatless dinner every week. My kids never noticed. I did not buy much 'convenience' food. An example of an inexpensive dinner would be a pasta with lots of veggies and a small amount of chicken added to that pasta or a stir fry. I cut the meat into small pieces, too, to make it appear to go further. We did not pay for cable or eat out much. And #1, as my parents taught me, "Pay yourself first." That means save money first. This helped us live through three tough years while I didn't work. Yes, we drained that savings, but I am so grateful I saved when I could. Our mortgage was $1000/mo, we had car payments, tuition payments, plus all the usual expenses of a family, and did it all on my husband's take home pay of $3000/mo. Sometimes, you really have to work and be disciplined to do it, but it can be done. I finally got a part time job, and we are keeping things simple and saving again.

DeleteGreat suggestion!!! It's so true!! Glad to hear your story and thanks for sharing!

DeleteAwesome story. I raised two children on my own and we shopped at Goodwill and lots of thrifting and coupons. You can do anything when you set your mind to it. I still thrift and I think of it as going on an adventure. If I find good stuff, I sell on Craigslist or eBay. Happy shopping everybody.

DeleteVery true! But I would like to know where you live to have an income of $2,000, pay $300 in rent and $100 in gas...

ReplyDeleteits not accurate its just an example. I didnt want to put actual amounts in. But i live at home with my parents for now so my rent is cheap and i drive a honda civic and have a short commute to work

DeleteLive in Idaho. My rent is $350 and I pay about $50-100 in gas a month depending on if I travel or not.

DeleteGreat post, I have been using this system for a few years now and I really does work. It is really hard at first but now its a game, can save more than I did last month. I have to stress though, make sure you have a little "fun" money or it doesn't work. As the old quote goes "All work and no play makes Jack a dull boy" you have to have a treat once in a while. I also save my 5 dollar bills as a slush fund, believe it or not 5's add up really fast and in a year I saved over $900, just suggestion.... Oh yeah where did you get your cash organizer? Love it :)

ReplyDeleteThis sounds a lot like Dave Ramsey 's Financial Peace University.

ReplyDeleteI listen to Dave Ramsey on iheart radio everyday and this sounds a lot like his show also.

DeleteExactly what I was thinking. Even the terms "Financial Freedom" are from his show.

DeleteLol well uhh yea i did say all over this blog that i love dave ramsey and most of the stuff i've done is from his method.

DeleteI didn't see Dave Ramsey mentioned once (in this post at least) and it seemed to me that you were taking all the credit for his ideas and methods. Glad you commented and corrected this. Its a great system and really works! Thanks for spreading it even more :)

DeleteAnd?

DeleteWhat would you suggest to a Senior in High School who has a minimum wage job! Pays for no "bills" like gas and car etc.... But loves to shop and has realized how much they spent in 2 years and wants to to learn how to manage money and save!!!

ReplyDeleteI'm not sure if I just missed this part or if I'm just confused but what do you do with the $440 difference? what do I do if I have a less that $10 difference?

ReplyDeleteI think the $440 difference was what you could be saving. Tracking how you spend what and when you spend it helps you see that. After you figure out what you need them you can try to cut back on what you really don't need. That's where your savings can start. And for now if it's just $10, save it. My Mom told me even if it's just $5 save it every month or every paycheck. You gotta start somewhere and then from there you can add more along the way when you can but sometimes it may only be $5 you can save, still save it because at least that is something going into your savings. After many attempts I finally stuck to it. I went from saving $10 a month to $100 sometimes $300. It has helped when needing new tires or a new refrigerator. I used it when heating bills or summer electric bills got out of control but still kept adding something in every pay period. You can do it, $10 is more than $0.

DeleteIf u have $440 (or whatever amount) remaining put that into savings and start over the next month.

DeleteNot only will it add up if u put it away u will not feel like u have that money to spend and it will get easier to put aside.

I have 3 bank accounts as well as the evelopes. I don't make much so I won't say how much I set aside but eventually I saved up short term and long-term emergency fund, non monthly bills and savings.

Don't worry about how long it takes it will get easier and eventually it will happen. It took a while but once you get there add the money to savings before removing it so the amount doesn't go down.

What is the envelope picture under step 4? I have done the envelope system before but that looks durable and I would like to purchase one like it.

ReplyDeleteStephanie these are from Dayrunner's website!

Deletecan you please post a link?

DeleteI recommend getting a safe to keep this in. You never know what's going to happen.

ReplyDeleteThis is a great idea! My struggle is that I get paid once a month, and nearly half of my paycheck goes to childcare.

ReplyDeleteI have the same issue. By the time I pay childcare over 1/4th of my check is gone.

DeleteI have done a saving system on this order for years except I take each bill and devide it by four. This way my money is saved and ready to pay my bills! I use a coupon holder listing each bill, I also put a section for Christmas funds. The only way this will work is don't touch the money if you need to you have to pay yourself back.

ReplyDeleteI have found that this works great if we remember to tithe. I always thought that I could not afford it. A lady at work told me a story that her mom had told her about not tithing. I then started tithing. After that, it seemed like I never had financial problems. So, believe me, you can't afford not no tithe.

ReplyDeleteThank you so much for this post. Years ago I use to be great at budgeting. Then I was married, had children and had to furnish a house and provide for a growing family. My budget went out the window, because of the "things we needed." I was able to take your budget model and model it into one of my own. I now feel comfortable and stress free, knowing that I have money to save, money for emergencies and monthly bills. No more living paycheck to paycheck in hopes that it will all work out with nothing saved. Thank you.

ReplyDeleteThis is a great practical way to budget. We wish there more people like you sharing your tips!

ReplyDeleteGreat tips! Do you just cash your check and put it in an envelop? I love that idea. I think it's great and really helpful!

ReplyDeleteMy check gets direct deposited so every friday i go to the ATM and get the cash out and put it in my envelopes :)

DeleteWhere could I buy the exact or similar organizer at? I saw that you said Target but do you have the name of the organizer?

DeleteIf you go to target it's in the area that has all the notebooks, office supplies, and file folders. Youll see them there!

DeleteFor folks who are REALLY strapped...been there. You can really scrimp on food for a few months. Cook everything at home. Use what food is in the cupboard instead of just shopping for more. Go to a food cupboard to help supplement. Don't be picky. Rice and beans with grated cheese on top is cheap. Shop at Aldi, not at pricy markets! Drop cable. Drop smart phones. Don't get your car washed. Don't dry clean..just wash your own clothes. Drop internet if you need to...you can always bike to a library to use internet, yeah it sucks, but might help you climb out of a financial hole. Read up on more budget tips online, that's what I did.

ReplyDeleteThis is all great information! Thank you Ellen for sharing and to all others who left advice, thank you. Saving money has never been something I've been able to do and living from paycheck to paycheck has become rather the norm for me. By the grace of God, I somehow purchased my first home. I realize I need to be on a budget so if something goes wrong, I could get it fixed. I don't want to drown in debt and right now I'm doggy paddling in it. I will try this method and truly appreciate the advice. Take care all.

ReplyDeleteI have always wanted to Try something like this but I never know where to begin and it very hard when mine and my husbands paycheck differ every month..they are never anywhere near the same..what do I do

ReplyDeleteI pay everything electronically so I don't think this would suit me, but for someone that uses cash it looks like a pretty neat system!

ReplyDeleteI was going to comment the same thing. I have dropped nearly all I can drop and pay electronically as well. I buy gas from Costco and the only form of payment is a debit card with at least $100 on it for authorization. The price for the gas is way cheaper, but that cuts out the cash option. Any suggestions? Also, I think I spend more with cash on hand...not sure how to become more disciplined

ReplyDeleteSo true Kim !

ReplyDeleteI tried this & will never go back!

ReplyDeleteThank you for your tips! I really need to analyze my spending habits. Especially the smartphone. After seeing how much you pay each month, I know I need to cut the cost of my service.

ReplyDeleteYoure welcome glad they are helpful to you!

DeleteOh Very nice. I see your post.. It's a very essential post and a big useful post for us. Thanks for share your effective content.I see this kind post a another website paycheck stubs keyword related.

ReplyDeleteWow that's great! Yes I believe you must tithe! What percentage do you tithe?

ReplyDeleteAt one time my hair stylist worked in a salon next door to a Starbucks and had several of their employees as clients. They told her that a number of workers from surrounding businesses (small strip mall retail stores, where nobody was getting rich) bought coffee two or three times a day. She and I did some rough math and figured out those folks were spending every month on coffee what she and I were spending on our mortgage payments. What a waste of money!!

ReplyDeleteWhat if most things either come out of your account automatically or you use your debit card for like gas. Nothing worse than going in and paying for gas

ReplyDeleteIf you go to the post that I linked to for my cash envelope system, I explain that I keep money in my account for bills and gas.

DeleteIt would be wonderful to go back to using all cash, but unfortunately what needs paying disappears out of my account before i even see it

ReplyDeleteIt all good, but spending money on a book or anything else would make me more broke than already I'm, but like the plastic holder for dividing the money, will see if I find one in goodwill.

ReplyDelete